The benefits of exercise: Why health savings accounts should be part of your financial routine

A version of this article originally appeared on Schwab's Main Street Stories.

Do you ever get that sneaking suspicion that you're using only a fraction of the computing power of your laptop or smartphone? You know it's capable of more but you either don't have the time or motivation to figure it out. It's not unusual, particularly when it comes to technology. But it happens in other parts of our lives too.

We recently conducted a survey1 of 401(k) savers, and among the topics we explored were the workplace benefits that matter most to them, and how they're putting those benefits to use. It revealed interesting facts about Health Savings Accounts (HSAs).

As workplace benefits go, HSAs are like a feature on your phone that you just might love if you knew about it and figured out how to use it.

The must-have benefits

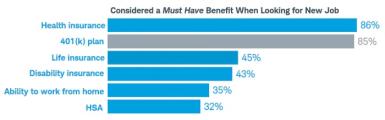

In our survey we asked respondents what the "must-have" benefits are when looking for a new job, and not surprisingly health insurance and 401(k) plans came in neck-and-neck at number one and number two. From there, we saw a considerable drop to life insurance and disability insurance, followed by the ability to work from home and then HSAs.

Among the top six must-have benefits, it's clear that healthcare is one of the leading expenses that people need to plan for – today and down the road. And while HSA use could be higher, given the rising number of employers offering them, it's clear they're growing in popularity.

According to the most recent Devenir Report2, there are approximately 28 million HSAs in the United States holding nearly $66 billion in assets, including $50.2 billion in cash and $15.7 billion in investments.

So what's the fuss?

Like 401(k)s, HSAs are another way to save and invest money now to help prepare for the future. They can be used for qualified medical expenses or saved for the future, and they have a triple tax benefit: pre-tax contributions, tax-free earnings, and tax-free withdrawals for immediate medical needs.

Additionally, HSA assets can be invested through a brokerage window specifically designed for these types of accounts. It's a great way to potentially grow these assets, but it's not yet well understood by HSA clients. Our research found that two-thirds of people with HSAs are aware their assets can be invested while one-third actually take investment action.

The benefits of exercise

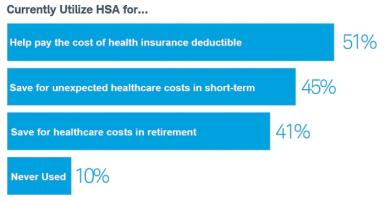

Among those using HSAs, our research found that more than half are using them for their current health insurance deductibles. Nearly half (45%) use them to save for unexpected short-term healthcare costs, and more than two in five (41%) use them to save for healthcare costs in retirement.

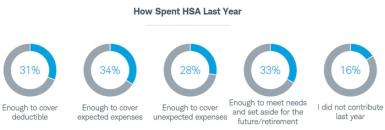

The IRS currently allows individuals to contribute $3,550 annually to an HSA, and families can contribute $7,100. People over 55 can contribute an additional $1,000 in catch-up contributions. Our survey found that the contributions HSA clients made last year went a long way toward meeting both near- and long-term goals.

Close the gap

HSAs are increasingly being offered by employers and are growing in popularity among retirement-plan participants. But a gap remains between accessibility and use, and there's a need for more education so HSAs are better understood.

As an industry, it's on us to help close the gaps. One part is helping people realize they might have an HSA option within their workplace benefits. The other part is helping them put those HSAs to work.